30 Things to Do Before Buying a House

30 Things to Do Before Buying a House

Do the work

Very few people will ever make a purchase bigger than a house. In fact, most people will only buy a home a few times in their life. That makes it critical to get the right home, at the right price, and with the right financing.

Accomplishing that requires you to put a lot of work in. Preparing to buy a home is a process that it often makes sense to start years before you’re actually ready to buy. Of course, most people won’t plan that far ahead, and no matter when you're looking to purchase a home, there are many things you can do to make the process go as smoothly as possible.

Previous

Next

Start saving

PMI is an added cost that only

protects the mortgage company in the even you default on the loan. In addition, paying more down lowers your payments and gives you more breathing room. Sellers also like

to see a larger down payment, because that suggests the buyer has a better

chance of being approved for a mortgage.

Previous

Next

Be aggressive

Whether it's your first house or your tenth, the more money you have to invest, the better your odds of getting what you want. From the point you decide you want to purchase a home, take a tough stance on your budget.

Don't make your life miserable for years, but cut any spending you can. Yes, that may mean bringing lunch from home or drinking the communal coffee at work, but those sacrifices will seem small if they get you your dream home.

Previous

Next

Clean up your finances

For most people, buying a home means getting a mortgage. Before you even consider doing that, you'll want to take some basic steps to clean up your finances. If you have unpaid bills, taxes, or any other debts, then work toward paying them off. If you have car loans, credit card debt, or any other debt that you can pay down, then do so ASAP.

If you can't afford to pay your cable company the $300 you owed when your service was shut off, then you can't afford a mortgage. Get your finances in decent shape (or at least have a plan to get there) before you even consider trying to buy a home.

Previous

Next

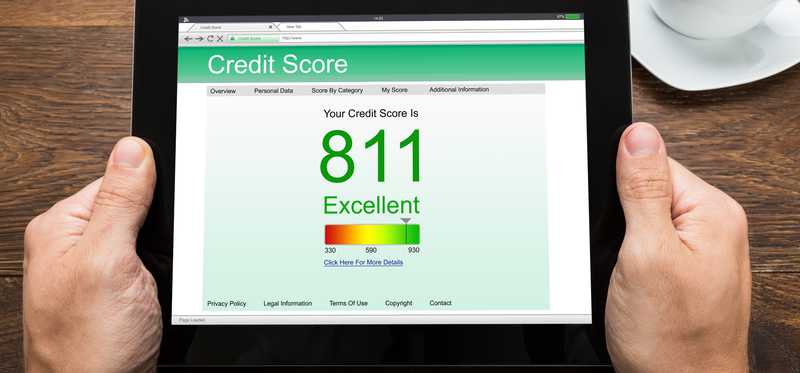

Know your credit score

Before you can fix your credit, you need to know what your score is. Credit scores range from 300 to 850, and higher numbers signal better creditworthiness. There are three major credit bureaus -- Equifax, Experian, and TransUnion -- and each one will have a slightly different score for you.

Some credit cards come with free access to one or more of the reports. In addition, you can use a paid service like MyFico.com to get access to all three scores.

Previous

Next

Understand your credit score

In addition to knowing what your credit scores are, it's important to know what they mean. Various lenders use different standards, but in a rough sense, here is what the numbers mean:

- Under 580 is poor

- 580 to 669 is fair

- 670 to 739 is good

- 740 to 799 is very good

- 800 to 850 is great

Having a low score won't necessarily prevent you from getting a loan, but it will likely force you to pay more for financing. People with higher scores will have more offers at better interest rates, and that can translate into thousands, or even tens of thousands, in savings over the life of the loan.

Previous

Next

Fix any mistakes in your credit reports

Your credit reports are maintained by the credit bureaus, and they contain the history of your debts, your payments to lenders, any accounts in collection, and more. You can check your reports for free once per year by visiting AnnualCreditReport.com, and you can purchase them from the credit bureaus at any time. In any case, you should certainly check them long before you apply for a mortgage.

Sometimes credit reports contain errors like debts you've already paid off, accounts you didn't open, or collections that you settled long ago. These kinds of errors can sink your credit score, so it's important to contact each credit bureau about any faulty entries and ask for them to be corrected. Be prepared with documentation to make a clear case that a mistake has been made.

Previous

Next

Improve your credit

For many people, the best thing about a credit report is that it's not permanent. You can improve your score, and to do that, you need to know how it's calculated. Again, numbers can vary, but this is roughly what makes up each of your three scores:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- New credit (10%)

- Credit mix (10%)

Two of the items, "payment history" and "length of credit history," can't be changed quickly. Amounts owed, however, accounts for a big chunk of your score, and you can improve that by simply paying down debt.

As for the last two, banks like to see that you can responsibly handle different loan types. They consider how many loans you've applied for recently (several applications in a short period looks bad) and whether you've paid back debts like car loans, student loans, or even store credit cards (variety looks good).

Don't apply for new loans solely to enhance your credit mix, because those new applications can ding your score, as can a larger overall debt load.

Previous

Next

Know your budget

In a rough sense most lenders want your mortgage payment (including any escrows for tax or insurance) to be no more than 28% of your monthly take home pay. That means that you can set the upper end of your budget using that number.

In reality, though, many people aren't comfortable spending that much, especially if a down payment wipes up much of their savings. Whatever your number, knowing what it is makes it much easier to figure out what houses are worth looking at.

Previous

Next

Know what you want (but be reasonable)

If you hate exposed brick or fireplaces, then it's important to know that and to inform your realtor. And if you love ranches or really want a pool, it's important to communicate that as well.

What you don't want, however, to be is inflexible. Rejecting a house that's perfect because it doesn't have a dual vanity may be taking things too far. The same is true of any other style point -- especially those that can be changed.

Have a needs list, a wants list, and a dreams list. If a house hits everything on your must list, be open to the idea that everything else is negotiable.

Previous

Next

Know what you don't want

When my son was under three and we were looking for a new house, open staircases were on our "absolutely not" list. For other people, deal-breakers may include a swimming pool, an unfinished basement, or any number of things.

In general, it's best to have very few absolutes, but there are some things that you simply won't tolerate or that won't fit your lifestyle. Knowing what those are can shorten the shopping process.

Previous

Next

Get the right help

When you get serious about buying a house, it's time to find a real estate agent. In general, it's OK to meet with different agents who have a listing you want to see. Before picking someone to work with, you'll want to make sure your personalities match. You'll also want to assess whether the realtor is committed to finding the right home for you or merely sees you as another sale.

When my wife and I moved to Connecticut about 20 years ago, we called an agent to see a listing he had in the town where we wanted to live. After talking with me for a while, he told me that he would show me the house, but he didn't think it was the right one for me based on what I had told him.

He easily could have shown me the house and sold me on it. However, because he put our interests before his own, we hired him for several more transactions, including the sale of our final Connecticut home before we moved to Florida.

Previous

Next

Know the market

Even before you pick a real estate agent, you can do some basic research using sites like Zillow and Realtor.com, which can give you insight into exactly what you can afford and where. That doesn't mean your agent won't find you a hidden gem, but if your budget is $200,000, and downtown two-bedrooms start at $400,000, it's best to know that up front.

Previous

Next

Know any special market quirks

When my wife and I moved to Florida, our real estate agent let us know that getting a mortgage for most condominium units would require a 25% down payment. That's because a number of condo projects had gone bankrupt during the housing crash, prompting banks and other lending institutions to tighten their lending standards for those types of properties.

That requirement likely helped us buy our home at a better price, because it reduced the field of potential purchasers. Of course, should we wish to sell, that former advantage could work against us, but with time, lenders could ease up.

No matter where you're hoping to live, there may be some unique laws, rules, or other quirks. Find out what they are before you look so you understand up front what you're getting into.

Previous

Next

Be ready to compromise

Should you really pass on a perfect house because it's not walking distance to the beach? Or should you sacrifice many of the items on your "wants" list to get a house close to the shore?

It's important to understand exactly where you (and anyone else who's involved in the purchase) are willing to compromise. If you're not willing to give up a single thing on your wish list, then you may need to increase your budget -- or spend a lot more time searching.

If the length of your commute means more to you than anything else, then tell your real estate agent that. That should save you time and keep you from looking at houses that will get crossed off your list because they break one of your clear demands.

Previous

Next

Know the intangibles

My wife and I have a 13-year-old, so before we bought our West Palm Beach condo, we did some research on the local school system. We learned that although the assigned schools would not be right for our child, the district's rules gave us some viable options.

Whether it's schools, crime statistics, or anything else, ask questions and know which towns or neighborhoods meet your needs. Your real estate agent can help you with this, but some questions require digging in yourself.

Previous

Next

Know your limits

I'd love to be able to buy a fixer-upper and tear the walls down to the studs. Unfortunately, I would then be left with no walls and no experience in building walls. Be realistic when deciding what work you can take on yourself when you buy a home. If you're an experienced home renovator and all-around handy person, then that's great. But if you're not, don't expect that you'll be able to get everything right -- least of all your remodeling budget.

Previous

Next

Get a pre-approval

Getting a mortgage pre-approval doesn't mean a whole lot. Basically, the lender runs your credit and asks some basic questions to see whether you will likely qualify for a mortgage of a given size. It's not a true test of whether you'll be approved.

That said, sellers prefer buyers who are pre-approved for a mortgage. An offer that comes with a pre-approval has a better chance of being accepted. That makes it worth getting -- and it does not obligate you to use that particular lender.

Previous

Next

Get your bank accounts in order

When it's time to apply for a mortgage, the lender will likely want to see the last three months of statements for any of your bank accounts. In addition, many banks and lenders want to see the details of any deposits that are not normal payroll amounts.

If you got a one-off bonus, or if you make uneven sales commissions, be prepared to defend the numbers with documentation. Also realize that until you close on a home, your lender will probably want to see each month's statement for all your accounts.

Previous

Next

Be prepared to account for your finances

Lenders worry that cash "gifts" from your family members are secretly loans, because that would mean your debt-to-assets ratio is higher than it looks. Therefore they generally ask any person who gives you a large sum of money to sign a document stating that it's not a loan.

If a loved one gives you a cash gift, then let them know this request is coming. The same is true of any other non-salary form of payment that shows up in your bank account. Whether you sold some stocks or cashed in some old bonds, be prepared to account for every dime.

Previous

Next

Have your taxes ready

Almost all mortgage lenders require two years of federal tax returns. This sounds easy, but your lender won't just accept what you hand in. Instead, the lending institution will verify your return with the IRS.

The problem for a growing number of people (my wife and I included) is that if you have your identity stolen to file false tax forms, the agency will no longer offer that verification. There are ways around this (our bank issued a waiver on the verification process), but you need to find out early on if you're going to have a problem.

It's also worth noting that for self-employed people, who often file taxes to maximize deductions and minimize income, there are now some alternative loans that don't ask for tax records. These may cost a bit more in interest and are not offered everywhere, but generally the lender will ask for two years of bank statements, rather your tax returns.

ALSO READ: Here's What Happens When Someone Steals Your Identity

Previous

Next

Consider the whole cost

When my wife and I first moved from a house to a condo, we didn't give much thought to having to pay a homeowner's association fee. In that case, it sort of made sense, because the HOA paid for things we had previously paid for each month, like snow removal and lawn maintenance.

When we moved to Florida, however, HOA fees could vary greatly. Our building has a doorman, a pool, a gym, and some other amenities. The HOA is about two-thirds the amount we pay for our mortgage each month.

Yes, we get a lot for the money, but it's a sizeable sum, and had we not planned for it, we could have come up short. Your budget isn't just your mortgage payment, or even your mortgages plus escrows; it's the amount you pay in total each month for housing, so remember to keep the full bottom line in view.

Previous

Next

Think about resale

When my grandfather died, my grandmother turned the entire upstairs of their house into one giant bedroom suite. It worked for her (and that was great), but it essentially turned a four-bedroom house into a two-bedroom house, and converting it back was not easy.

That hurt its resale value (and the buyer ultimately tore it down). Be careful when buying a house that meets your current needs but will be tough to resell because of how specific those needs are.

Previous

Next

Flush the toilets

You can tell a lot about a house based on how its toilets flush. When you search for homes and find one you like, make sure you give the toilets a flush. If the water flow is weak, that may be a sign of an emerging plumbing problem.

Yes, a good home inspector may pick this up, but home inspections are about finding existing problems -- not ones that are developing.

If a toilet does not flush well, it's a sign something may be wrong. That may not be a deal-breaker, but it's worth looking into.

Previous

Next

Ask if there have been any problems

Every state has different laws when it comes to what goes on a disclosure form. That means that if you suspect there's a problem, it never hurts to ask about it.

For example, we once sold a house that had a minor plumbing issue. In solving that problem, we learned that the pipes were directly under our living room, and a major problem would require digging them up.

That's not something that needed to be disclosed, but it's information we would have volunteered if someone had asked, "Is there anything that worries you about the house?" Not everyone will be as honest, but you can learn things just by asking.

Previous

Next

Check the schools

Even if you don't have kids, schools can be an important factor when it comes to buying a house. A lousy school district can impact resale value. Of course, that can also be a positive if you don't have kids, plan to stay for a long time, and aren't worried about resale.

If you do plan to use the schools, look into things like how busing works and whether your child can walk to school. It's also useful to know the private, charter, and alternative school options even if it's only on a just-in-case basis.

Previous

Next

Make sure it’s enough house

My wife and I are cautious with our finances. Because of that, when we bought our first few houses, we kept our budget smaller than we needed to. That left us with houses that only met our short-term needs.

Because we were too careful, we ended up moving more often than we otherwise would have. That cost us more money in closing fees, commissions, and moving than we would have spent to buy a house that fully met our needs in the first place.

Previous

Next

Don't fall in love with one feature

Maybe you you'd love to have a pool or a great view of the beach. Finding a home in your price range that has the one thing you really want is great, but it can also blind you to other problems.

Having the right number of bedrooms is more important, for example, than having a fireplace. Go after what you really want, but don't forget what you actually need.

Previous

Next

Understand closing costs

Closing costs vary by market, transaction, and type of loan. They can add thousands to the amount of money you need to close your loan.

Your lender should give you an estimate of your closing costs well before the closing date. The number is a moving target due to changing escrows, partial payments, and other factors that change based on the exact day you closed. Still, the final number should not surprise you, and it should be factored into your budget early on.

Previous

Next

Look into moving costs

Sometimes people get so caught up in the financial considerations of buying a house that they forget it can be expensive to move. Look into moving costs before you figure out your budget, but remember that you can bring the expense down by doing things yourself.

For example, when my wife and I moved from Connecticut to Florida, we did so via a truck we rented. We hired moving help at both ends (which cost maybe $400 plus tips for both), but I drove the truck down along with a friend. We saved somewhere between $5,000 and $8,000 by not hiring movers, given the distance and the amount of stuff we had.

Previous

Next

Make sure you like it

It sounds silly, but sometimes the house-buying process gets so intense that you forget to think through what it will actually be like to live on the property. This once happened to my wife and I after we had been outbid for a number of houses we really liked.

We ended up buying a house that neither of us cared for all that much. We had "won" the bidding process, but we had lost sight of what we really wanted. It's an easier mistake than you may realize, so before you sign anything, step back and make sure you're excited to live in the house you're buying.

ALSO READ: 3 Reasons It Pays to Buy a Home in 2018

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.